A question we hear often from target companies and investors is “Do we really need to be present in China?”. The answer is “Yes” and here is why.

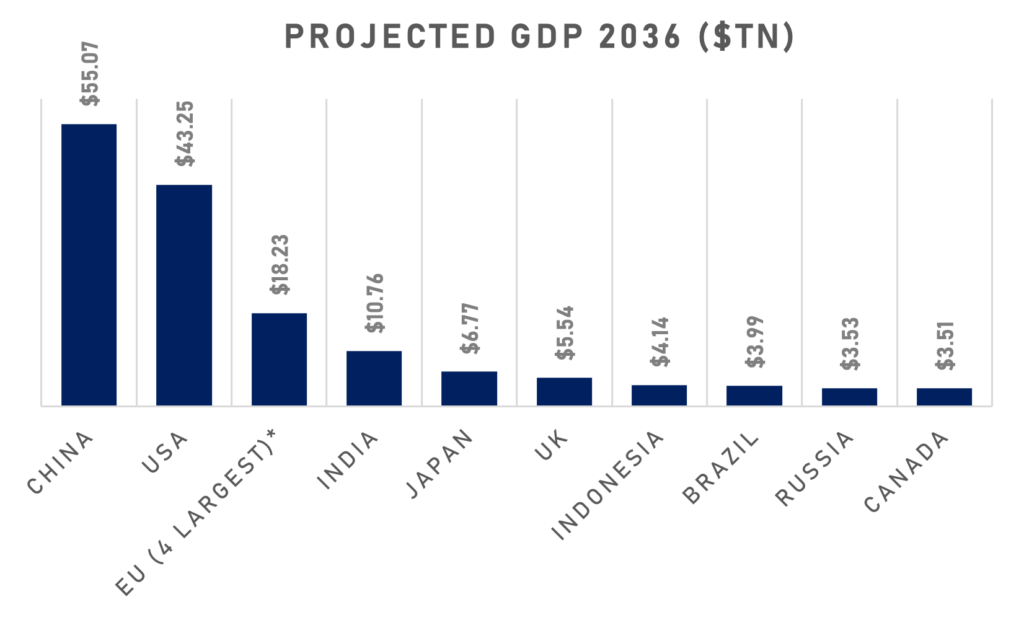

*Consisting of Germany ($7.44tn), France ($4.77tn), Italy ($3.43tn), and Spain ($2.57tn).

Source: The Centre for Economics and Business Research

Over the next 30 years, the main world economic growth will be in the combined markets of US, EU and China (for lack of a better term, the “1st tier economies”).

Only companies that can win in their segment in these 1st tier economies are able to become global leaders. Those who are not present here, can compete for a short while, but will eventually get overtaken due to lack of access to the same market scale and growth.

Between these markets, China is probably the hardest market to access, but also the fastest growing one. Thus, China needs to be early on the agenda and a key strategic priority.

This is the simple answer, but there is much more to it. We refer to the excellent work by Prof. Hermann Simon (link: www.hermannsimon.com) and his books on “Hidden Champions”.

The key notion of Prof. Simon is that companies can be global leaders without being fortune 500 companies. These “unknown” market leaders are called “Hidden Champions” and they are key for economic growth.

How to Win:

The natural follow-on question of a Target is often then “Ok, so how do we win in our segment in China?”. The answer depends on the industry and product, but for B2B companies there are a few general rules:

- Look for ‘pull sectors’, which include:

- New Energy & Energy Storage;

- Digitalization, AI and IoT; and

- Healthcare and Biotech.

- Focus on breakthrough innovation on one focus product, or even a key part of a product;

- Look for high volume, but anticipate lower margins;

- Be ready to work with local companies on local integration, assembly, partial production and servicing; and

- Work with local people and partners that you can trust.

Achieving Market Access:

The next question we get is then “How can you help us achieve this?“. At LvS Partners, we invest + actively manage the expansions of leading tech companies to Asia and particularly China. We take a hands-on approach to assist innovative companies to successfully enter and grow.

It is our singular focus to act as the active China investment partner for tech companies in our target industries.

This partnership includes:

- Our investment in the Target’s global, Asia regional and/or China operations;

- Adapting and localizing the strategy, marketing and product or service;

- Achieving first sales or pilot projects and expanding the footprint from there;

- Establishing robust regulatory compliance and governance practices for China operations;

- Building a local ecosystem of strategic partnerships and collaborations; and

- Helping overcome China’s significant cultural barrier.

Implementing & Execution:

This sometimes leads to some unbelief, “Can this all really be done?”. Yes, it can.

We manage and oversee all aspects of the expansion in order to provide smooth, consistent and secured access to the Chinese market. This is by no means a simple task. It requires constant discovery, fast adaptation, and a consistent push forward.

Our management has worked for decades on the ground in China to understand how to execute this and build up the required network. The boots-on-the-ground experiences and constant challenges of this work put us on an equal footing with the management of the tech companies we invest in. This professional, experienced and focused cooperation is what we seek in all our investments.

For More Information:

If you are interested to discuss partnership further, either as a Target or an Investor, or would like to see our track record, please contact us directly at:

max@lvspartners.com.